Spending Responses to News about Dividend Taxes

17 June 2024

Martin B. Holm (University of Oslo), Rustam Jamilov (All Souls College, Oxford), Marek Jasinski (Statistics Norway) and Plamen Nenov (Norges Bank)

Business tax paper of the month - June 2024

A Norwegian tax reform raised the dividend tax rate by 28 percentage points in 2006. In our recent paper “Estimating the Elasticity of Intertemporal Substitution using Dividend Tax News Shocks”, we show that exposed households responded to the reform by increasing spending after the news and reducing spending after implementation. These findings have important implications for the elasticity of intertemporal substitution (EIS).

Do higher interest rates lead to higher or lower saving? Even though this question may appear to have a simple answer, it is far from clear empirically and has been at the center of a heated debate in both finance and macroeconomics. When it comes to consumption and saving decisions, there are many instances in macroeconomics when the empirical evidence is consistent with higher interest rates actually lowering saving. The question goes far beyond an abstract debate in academia - it is central to our understanding of the effects of monetary policy, of the determinants of stock market valuations, and also of capital taxation. For example, if higher interest rates lead to less saving, then taxing capital income may be socially optimal (Straub and Werning, 2020). The parameter governing the response of saving to interest rate changes is called ”the elasticity of intertemporal substitution,” or EIS for short.

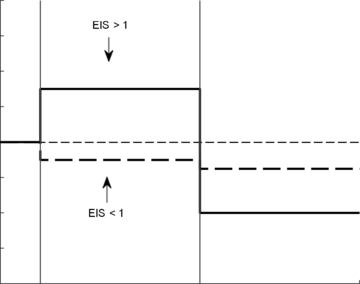

A particularly important threshold for the EIS is unity. If the EIS is greater than one, then higher interest rates increase savings. When it is lower than one, then higher interest rates decrease savings. The reason for these different responses are the so-called ”income” and ”substitution” effects induced by the interest rate change. On one hand, higher interest rates mean that an investor would be more willing to substitute current consumption for future consumption. On the other hand, it also means that one gets a higher return, so consumption is cheaper overall, and one can then consume more both now and in the future. Which of these two effects dominates is determined by the value of the EIS relative to unity.

One major reason why there is still a debate about the value of the EIS is that it is notoriously hard to estimate. It may seem simple: we just want to estimate the response of spending growth to real interest rate changes. However, the interest rate is an equilibrium object and therefore often endogenous. In most cases, the underlying variation that caused the interest rate to move will also affect consumption.

(a) Example consumption paths in response to a lower R2

(b) The spending response to the 2006 Norwegian dividend tax

reform.

A more fundamental problem is that one needs to exploit variation in future interest rates to identify the elasticity of intertemporal substitution (Flynn et al., 2023). The issue is that current interest rate changes induce immediate income effects, making inference and mapping to theory unclear. Future interest rate changes, on the other hand, induce standard income and substitution effects on current consumption.

Specifically, consumption responses to future interest rate changes allow us to partially identify the elasticity of intertemporal substitution relative to unity. Figure 1a illustrates this intuition. For a lower future interest rate, the sign of the consumption response before the interest rate falls tells us whether the elasticity of intertemporal substitution is above or below one. If consumption falls and saving increases, the income effect dominates and the EIS is below one. If consumption increases and saving falls, the substitution effect dominates and the EIS is above one.

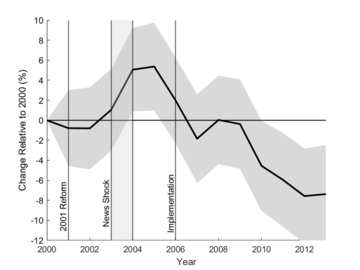

Building on this intuition, we exploit a dividend tax reform in Norway to partially identify the elasticity of intertemporal substitution relative to unity. In 2003, a government- appointed commission recommended introducing a 28% dividend tax. In 2004, the government announced that it would introduce a dividend tax of 28%. Importantly for our identification, although announced in 2004, the government planned to implement the reform in 2006, which it also did. The reform was therefore an announced decline in future returns, exactly like in the theory.

To estimate this spending response, we exploit variation in exposure to the reform using an empirical method called difference-in-differences. We compare private business owners with high dividend income as a share of gross income before the reform with other wealthy households who received no dividend income before the reform. Our treated owners thus received a large share of their income from dividends, implying that the introduction of a dividend tax should affect their behavior. In contrast, in our control group, dividend income plays a much smaller role.

Figure 1b shows the main result. Spending of our treated owners increased in 2003- 2005 before declining after the dividend tax was introduced in 2006. The spending increase before the reform is consistent with an intertemporal substitution above unity. In the paper, we also present a structural model of workers and capitalists to provide an estimate of the value of the elasticity of intertemporal substitution. We find that the spending response is consistent with an elasticity of intertemporal substitution close to 2.

Overall, our paper brings new evidence for the value of the elasticity of intertemporal substitution in the population of business owners and also sheds light on the real economic effects of dividend tax reforms. Our high estimate of the EIS suggests that capital owners may be more responsive to capital income taxation than previously thought.

References

Flynn, Joel P, Lawrence DW Schmidt, and Alexis Akira Toda, “Robust comparative statics for the elasticity of intertemporal substitution,” Theoretical Economics, 2023, 18 (1), 231–265.

Holm, M.B., Jamilov, R., Jasinski, M. and Nenov, P., 2024. Estimating the elasticity of intertemporal substitution using dividend tax news shocks. Working paper.

Straub, Ludwig and Iva´n Werning, “Positive long-run capital taxation: Chamley-Judd revisited,” American Economic Review, 2020, 110 (1), 86–119.